Open Your Prospective with Specialist Loan Services

Wiki Article

Simplify Your Financial Journey With Trusted and Efficient Funding Providers

Trusted and effective finance solutions play a crucial duty in this process, using people a trusted path towards their economic goals. By comprehending the advantages of working with respectable loan providers, discovering the various kinds of lending solutions available, and honing in on essential factors that identify the ideal fit for your demands, the path to economic empowerment becomes clearer - mca loans for bad credit.Advantages of Relied On Lenders

When looking for monetary support, the advantages of picking relied on lending institutions are critical for a secure and dependable loaning experience. Relied on lending institutions offer openness in their terms, providing customers with a clear understanding of their responsibilities. By dealing with trustworthy lenders, customers can stay clear of hidden fees or predacious practices that can result in economic challenges.Additionally, trusted loan providers often have developed connections with governing bodies, making certain that they run within legal limits and comply with sector requirements. This compliance not only secures the consumer but also fosters a feeling of count on and trustworthiness in the loaning procedure.

In addition, reputable lending institutions prioritize client service, using support and advice throughout the borrowing journey. Whether it's clarifying loan terms or aiding with payment alternatives, trusted lenders are committed to aiding borrowers make educated monetary choices.

Kinds of Financing Services Available

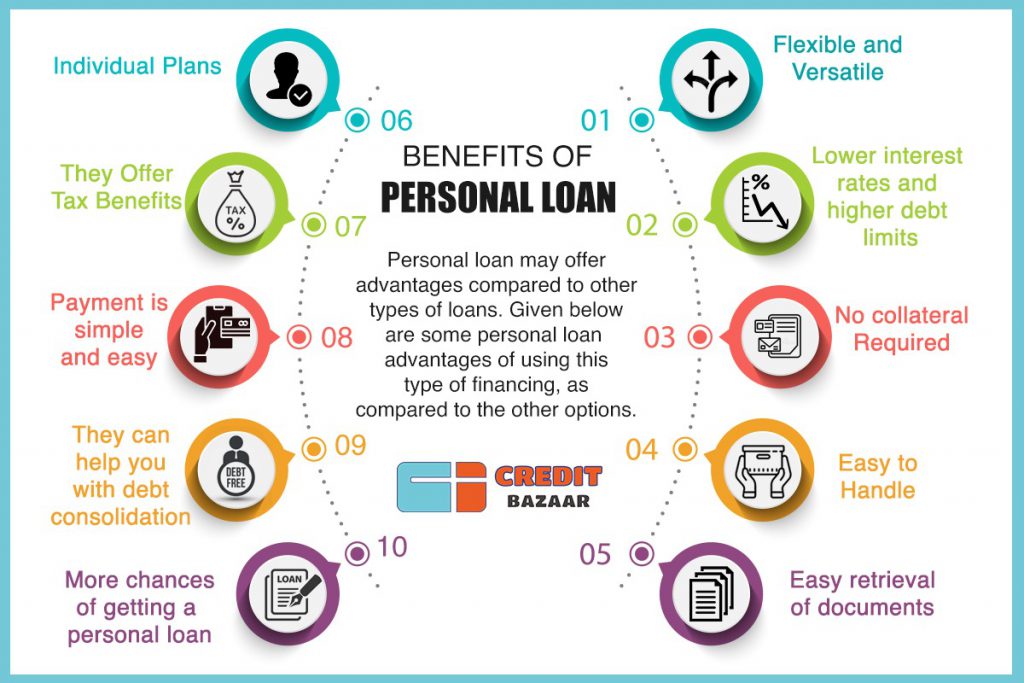

Numerous financial establishments and financing companies use a varied range of financing solutions to deal with the varying needs of borrowers. Several of the common kinds of financing services offered include individual car loans, which are typically unprotected and can be used for different objectives such as financial obligation combination, home restorations, or unanticipated expenses. Home loan loans are particularly created to help people acquire homes by offering considerable amounts of cash upfront that are paid off over a prolonged duration. For those looking to purchase an auto, auto fundings provide a means to finance the acquisition with dealt with regular monthly payments. In addition, business financings are readily available for business owners seeking resources to start or broaden their endeavors. Trainee fundings satisfy instructional expenses, providing funds for tuition, publications, and living costs during scholastic quests. Understanding the various sorts of finance services can aid customers make notified decisions based upon their specific financial needs and goals.Variables for Picking the Right Car Loan

Having actually familiarized oneself with the varied array of car loan solutions available, customers have to thoroughly evaluate vital variables to select the most appropriate lending for their specific economic needs and purposes. One crucial aspect to consider is the rate of interest, as it directly affects the total amount paid off over the lending term. Borrowers ought to contrast rate of interest from different loan providers to safeguard the most competitive choice. Loan conditions likewise play an essential duty in decision-making. Comprehending the repayment timetable, fees, and charges related to the financing is important to prevent any kind of surprises in the future.In addition, borrowers should evaluate their present monetary circumstance and future leads to figure out the car loan quantity they can pleasantly pay for. It is suggested to obtain just what is essential to reduce the economic burden. Additionally, evaluating the loan provider's credibility, client service, and general transparency can add to a smoother borrowing experience. By carefully taking into consideration these factors, debtors can pick the appropriate financing that straightens with their financial objectives and abilities.

Streamlining the Funding Application Refine

Performance in the car loan application procedure is extremely important for guaranteeing a seamless and expedited borrowing experience. To enhance the car loan application process, it is vital to give clear guidance to candidates on the called for documentation and details - Loan Service. Utilizing on-line platforms for application entries can dramatically minimize the moment and effort associated with the process. Carrying out automated systems for confirmation of documents and debt checks can speed up the application review process. Using pre-qualification choices based on basic info given by the candidate can aid in removing ineligible candidates early. Supplying routine updates to applicants on the condition of their application can improve openness and client contentment. Streamlining the language made use of in application kinds and communication products look at these guys can assist in far better understanding for applicants. By including these streamlined procedures, financing carriers can use an extra effective and straightforward experience to consumers, eventually improving total customer satisfaction and loyalty.

Tips for Effective Lending Repayment

Navigating the path to successful financing settlement needs careful planning and self-displined economic monitoring. To make certain a smooth payment journey, beginning by producing a comprehensive budget plan that includes your financing payments. Understanding your earnings and expenses will help you allocate the necessary funds for prompt settlements. Consider establishing automated settlements to stay clear of missing deadlines and incurring late costs. It's additionally advisable to pay greater than the minimum amount due monthly ideally, as this can help in reducing the overall passion paid and reduce the repayment duration. Prioritize your finance payments to avoid skipping on any type of loans, as this can negatively affect your credit history rating and financial stability. In case of financial problems, interact with your loan provider to discover feasible options such as funding restructuring or deferment. By remaining organized, aggressive, and financially disciplined, you can efficiently navigate the procedure of repaying your car loans and accomplish greater economic freedom.Final Thought

In conclusion, using trusted and effective finance solutions can significantly streamline your financial journey. By thoroughly selecting the best loan provider and kind of car loan, and enhancing the application procedure, you can ensure an effective borrowing experience.Report this wiki page